Responsible investment

The main responsibility of Sistema as an investor is the effective management of portfolio assets and funds to create shared value for shareholders and a wide range of stakeholders in the long term.

The Corporation aims to build competitive businesses with high added value that meet the principles of social and environmental responsibility and contribute to the sustainable development of industries and regions of operations and to the steady growth of economic and technological potential, human capital, quality of life and well-being of society.

Sistema follows the international concept of responsible investment, which implies integration of environmental, social and governance (ESG) factors into the strategic decisions making. ESG factors are applied both to the choice of priority areas for financial investments, valuation of assets and to interaction with key stakeholders:

Sistema’s strategic approach to responsible investment is solidified in:

1. The investment criteria, which are approved by the Board of Directors and integrate:

- ESG factors reflecting the Corporation’s guiding corporate responsibility principles as a part of Sistema’s Sustainability Policy;

- international ESG standards;

2. In the policies and procedures of corporate governance.

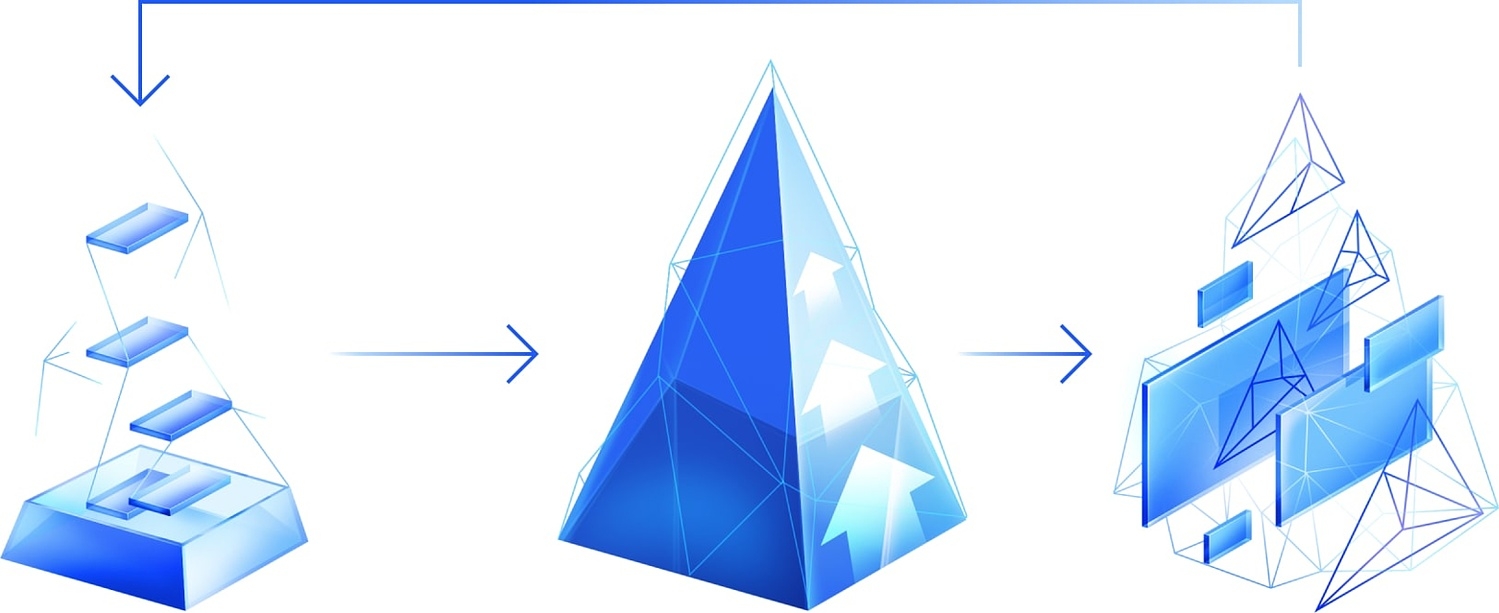

Sistema implements the principles of responsible investment at all the stages of asset ownership:

Implementation of the responsible investment principals

PDF

Portfolio building

- tobacco and pornography;

- gambling;

- producing or selling products or any operations that are considered unlawful in the country of operation or are subject of international bans (for example, ozone depleting substances, endangered plants and animals, use of child or forced labour);

- production of controversial types of weapons and components (landmines, biological and chemical weapons, cluster bombs, radioactive ammunition, nuclear weapons).

- evaluating governance, environmental and social performance of investees as part of due diligence process (covering management systems and policies, management of non-financial risks, ESG indicators, incidents etc).

Asset management

- the recommended share of independent directors on the BoD — at least 30%;

- Commitment to the BoD’s diversity in terms of expertise, gender, social and cultural factors;

- оne of the BoD’s committees should be charged with responsibility for sustainability matters;

- sustainability matters should be included in the recommended schedule plan of BoD;

- сorporate ESG policies (at least a Code of Ethics with clauses on human rights, anticorruption, whistleblower and personal data protection policies) should be in place.

- setting up a sustainability working group reporting to the CEO;

- developing a sustainability strategy including goals and KPIs for material issues.

- promoting uniform corporate governance and business ethics principles in Sistema’s portfolio companies;

- strategy implementation, improvement of sustainability management processes and ESG performance;

- forming a corporate culture based on the responsibility principles;

- encouraging innovation and improving operational efficiency;

- implementation of the Corporation-wide program of social investment and volunteering;

- monitoring and corporate sustainability reporting;

- supporting engagement between the portfolio companies on business and sustainability issues.